professional and independent property valuation services across Melbourne

Welcome to A2 Valuation Specialists

Melbourne's trusted property valuers

Contact Us

Our Key Services

Property Sales Valuations

Property Purchase Valuations

Rental Appraisals

Insurance Valuations

Stamp Duty Valuations

Specialised Valuations

Valuation News

The Importance of Independent Property Valuation in Melbourne

When it comes to real estate, the value of your property is one of the most critical pieces of information you can have. Whether you’re buying, selling, refinancing, or resolving legal matters, an independent property valuation is essential. In this article, we delve into the importance of independent property valuations and why you should consider engaging expert property valuers in Melbourne.

What is an Independent Property Valuation?

An independent property valuation is an objective assessment of a property’s market value, conducted by a certified property valuer. Unlike valuations provided by real estate agents, which may be influenced by sales targets or market hype, an independent valuation offers an unbiased and accurate reflection of your property’s worth based on thorough research and analysis.

Why You Need Independent Property Valuers in Melbourne

Melbourne’s dynamic property market makes it essential to have a valuation that truly reflects the current market conditions. Whether you’re dealing with residential, commercial, or industrial property, an independent valuation provides you with a reliable figure that can be used for various purposes, including:

- Purchasing or Selling a Property: Knowing the true value of a property can help you negotiate a fair price, ensuring that you neither overpay nor undersell.

- Refinancing: If you’re looking to refinance your mortgage, an independent valuation is often required by lenders to assess the current value of your property.

- Legal Disputes: In cases of divorce settlements, estate planning, or disputes over property, an independent valuation is critical for ensuring a fair outcome.

- Investment Analysis: For investors, understanding the exact value of a property is crucial for making informed decisions about potential investments.

The Benefits of Engaging Melbourne’s Property Valuers

Property valuers Melbourne have an in-depth understanding of the local market, giving them the ability to provide accurate and detailed valuations that you can trust. They consider a wide range of factors, including location, property condition, market trends, and comparable sales, to deliver a comprehensive report that meets your needs.

By choosing an independent property valuation, you ensure that you have a solid foundation for any property-related decisions, free from external pressures or biases.

Contact the Specialists in Property Valuation Services

If you’re in need of a professional, independent property valuation in Melbourne, it’s crucial to work with experienced property valuers who understand the intricacies of the local market. Our team of specialists is dedicated to providing accurate, reliable, and thorough valuations tailored to your specific requirements. Contact us today to get your property valued by the experts.

In-Depth Guide to Commercial Property Valuation in Sydney

Understanding the value of commercial property in Sydney is crucial for investors, property owners, and financial stakeholders. This comprehensive guide delves into the methodologies, factors, and nuances of commercial property valuation in one of Australia’s most vibrant real estate markets.

What is Commercial Property Valuation?

Commercial property valuation is a detailed assessment conducted to determine the worth of properties used for business purposes, such as offices, retail stores, and industrial facilities. Professional valuers perform this assessment by considering various influencing factors to arrive at an accurate market value.

Importance of Accurate Valuation in Sydney

Sydney, being a major business hub of Australia, sees diverse and dynamic real estate activities. Accurate valuations are pivotal for:

- Strategic Decision Making: Whether selling, buying, or developing properties.

- Financial Planning: Essential for securing loans and attracting investments.

- Legal Compliance: Ensuring property taxes and insurance premiums are based on the real value.

Critical Factors Affecting Property Values in Sydney

- Location: Proximity to central business districts, transport facilities, and commercial amenities significantly affects values.

- Economic Indicators: Interest rates, economic growth, and employment rates can sway property values.

- Market Conditions: Current demand and supply trends provide a snapshot of the potential market movements.

- Property Characteristics: Age, architectural style, building condition, and layout play crucial roles in valuation.

Valuation Methodologies Explained

- Comparative Market Analysis: Comparing the property with similar ones recently sold to gauge its market value.

- Income Capitalization Approach: Focuses on potential revenue generation capabilities, commonly used for rental properties.

- Replacement Cost Method: Estimates the cost to reconstruct the property at current material and labor prices.

Navigating the Valuation Process

A typical valuation process includes:

- Initial Consultation: Gathering basic information about the property and its use.

- Physical Inspection: Detailed checking of the property’s condition and features.

- Data Collection and Analysis: Gathering and analyzing data from various sources to apply suitable valuation methods.

- Report Compilation: Presenting the findings in a detailed report which outlines the valuation and its influencing factors.

Tips for Property Owners

- Maintain Your Property: Regular maintenance and timely renovations help in preserving and enhancing the property’s value.

- Stay Informed: Keeping abreast of market trends and economic shifts can provide insights into potential valuation changes.

- Engage Experts: Collaborate with experienced valuers who understand Sydney’s commercial real estate landscape.

Conclusion

Whether you’re a seasoned investor or new to commercial real estate, understanding the nuances of property valuation in Sydney is vital. It not only aids in making informed decisions but also ensures that your investments are on solid ground.

How Much Does a Property Valuation Cost? Understanding Fees and Estimates

Factors Influencing Valuation Costs

Determining the cost of a property valuation in Sydney hinges on various factors, including the type of property, its size, and the required level of detail in the report. Understanding these elements can help property owners and buyers estimate the fees involved accurately.

Property Type and Size

The nature and dimensions of a property play a significant role in valuation costs. Residential properties, for instance, often incur different fees compared to commercial or industrial properties. Key factors include:

- Residential vs Commercial: Residential valuations are typically more straightforward, whereas commercial properties may need more in-depth analysis due to their complexity.

- Property Size: Larger properties or those with unique features often require more time and resources to evaluate, impacting the cost.

Level of Detail Required

Valuation reports can vary in complexity. A basic valuation might suffice for some purposes, but others might necessitate a detailed report, considering aspects like market trends, property condition, and future projections. The more comprehensive the report, the higher the likely cost.

Getting a Quote for Your Valuation

Obtaining an accurate quote for property valuation involves several steps:

Research Local Valuers

Start by identifying professional valuers in your area. Look for those with expertise in your specific property type and a good reputation in the industry.

Provide Detailed Information

When requesting a quote, be prepared to provide detailed information about your property, including its type, size, location, and any special features or circumstances that might affect its value.

Compare Estimates

It’s advisable to get estimates from multiple property valuers Sydney to ensure competitive pricing. Remember, the lowest cost doesn’t always equate to the best value. Consider the valuer’s experience and the scope of their services.

Navigating Valuation Costs with Ease

Understanding the factors that influence valuation costs is key to budgeting effectively for this important service. By researching local valuers, providing comprehensive property details, and comparing estimates, property owners and buyers can navigate the valuation process with confidence and ease.

Record-Keeping for Investment Property Tax Deductions

Effective management of investment property in Melbourne involves meticulous record-keeping, especially when it comes to claiming tax deductions. This article focuses on the essential valuation-related documentation that property investors need to maintain for property depreciation deductions.

Understanding Property Depreciation Deductions

Depreciation on an investment property is a tax deduction claimable over the life of the property. It compensates for wear and tear, ageing, and obsolescence. Keeping accurate records is vital to maximise these deductions.

Types of Property Depreciation

Capital Works Deductions: Relate to the building’s structure and fixed items.

Plant and Equipment Deductions: Pertain to removable fixtures and fittings.

Essential Valuation Documents for Tax Records

Maintaining comprehensive valuation documentation is critical for substantiating depreciation claims.

- Purchase Contract: Indicates the property’s original value at the time of purchase.

- Loan Documents: Provide evidence of acquisition costs and financial arrangements.

- Quantity Surveyor’s Report: Details the value of depreciable assets within the property.

- Improvement and Repair Receipts: Record any enhancements made to the property, impacting its value.

Role of Melbourne Investment Property Accountants

A Melbourne Investment Property Accountant is an invaluable resource in managing property tax records and maximising deductions.

Services Offered by Property Accountants

- Providing advice on record-keeping practices.

- Assisting in identifying deductible expenses.

- Ensuring compliance with Australian Taxation Office (ATO) requirements.

- Preparing and lodging tax returns.

Best Practices in Record-Keeping

Effective record-keeping involves more than just retaining documents. It requires an organised and proactive approach.

Key Strategies for Effective Record-Keeping

- Maintain a dedicated file for all property-related documents.

- Keep digital copies as backups for all physical documents.

- Update records regularly, especially after major property events (like renovations).

- Consult with a Melbourne Investment Property Accountant for tailored advice.

Understanding ATO Guidelines

Familiarity with ATO guidelines on property investment and tax deductions is crucial for compliance and maximising benefits.

ATO Requirements for Property Investors

- Retain records for a minimum of five years.

- Ensure all claims are substantiated by relevant documentation.

- Understand the specific rules related to property depreciation.

Step-by-Step Guide to Disputing a Property Valuation

When it comes to Melbourne property valuation, sometimes disagreements can arise between homeowners and the valuers. If you feel that the assessed value of your property is incorrect, it’s important to know how to dispute it. In this step-by-step guide, we will walk you through the process of disputing a property valuation.

1. Understand the Assessment Process:

Before diving into the dispute, it’s crucial to understand how property valuations are assessed. Valuers consider various factors such as location, property size, condition, recent sales data, and market trends. Familiarize yourself with these aspects to have a better understanding of the valuation process.

2. Obtain a Copy of the Valuation Report:

To begin the dispute process, you need to obtain a copy of the valuation report. This report outlines the reasoning behind the assigned value and provides essential details about the property. Once you have this document, review it thoroughly to identify any discrepancies or potential areas of contention.

3. Gather Evidence:

Building a strong case for disputing a property valuation requires supporting evidence. Start by collecting recent sales data of properties comparable to yours in the same area. Look for discrepancies in size, condition, or location that might have affected their values. Additionally, gather any documentation related to property improvements or unique features that were not accounted for in the valuation.

4. Contact the Valuation Firm:

Reach out to the valuation firm responsible for assessing your property. Engage in a polite and professional conversation to discuss your concerns regarding the valuation. Present your evidence and provide a clear explanation of why you believe the assessed value is inaccurate. Request a reassessment of the property considering the discrepancies you have identified.

5. Seek Independent Advice:

If the initial discussion with the valuation firm does not lead to a resolution, seek independent advice from a qualified property valuer or a real estate professional. They can provide an unbiased opinion and further support your case during the dispute process. Their expertise can prove invaluable in strengthening your argument.

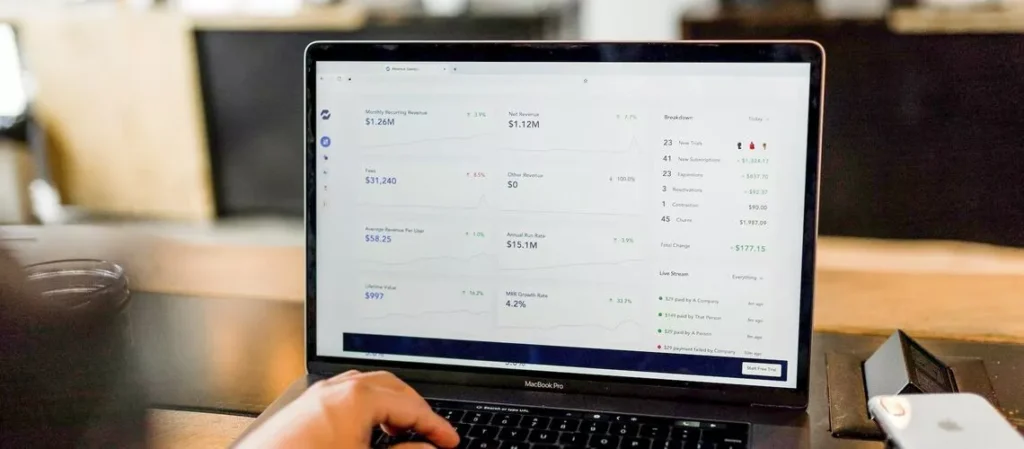

Understanding Capitalization Rates and Their Impact on Property Values

A capitalization rate (cap rate) is a key metric used by real estate investors to evaluate potential returns and analyse property values.

What is a Cap Rate?

In simple terms, the cap rate is the ratio between the net operating income produced by an investment property and its current market value. It is calculated by dividing the net operating income by the property value.

Mathematically:

Cap Rate = Net Operating Income / Current Market Value

The cap rate expresses the relationship between the income generated by a property and its market value. It shows the expected rate of return an investor can anticipate from owning that property.

How Cap Rates Relate to Property Values

Cap rates have an inverse relationship to property values. In other words:

- Lower cap rates correlate with higher property values

- Higher cap rates correlate with lower property values

For example, a property valued at $1 million that generates $100,000 in net operating income has a cap rate of 10% ($100k / $1m). If the property value increased to $2 million but the income remained the same, the new cap rate would be 5% ($100k / $2m).

So as a property becomes more valuable, its cap rate declines. And vice versa – if values decline, cap rates move upward.

What Factors Influence a Property’s Cap Rate?

Many factors impact cap rates, including:

- Interest rates – Lower interest rates reduce cap rates, while higher rates push them upward.

- Market conditions – A strong, growing economy typically causes cap rates to fall as demand rises. Weaker conditions cause rates to rise.

- Location – Properties in prime locations usually have lower cap rates than secondary locations.

- Property type – More stable assets like government tenanted offices tend to have lower cap rates than volatile assets like hotels.

- Lease terms – Long lease terms lower risk and decrease cap rates. Short leases raise rates.

Unpopular Opinion: Most Homeowners Overestimate Their Property Value

Many homeowners have an inflated sense of how much their property is truly worth on the open market. Sentimentality and lack of impartiality mean they often overvalue their most prized asset – their home.

Why Homeowners Overestimate Their Home’s Market Value

There are several psychological and emotional factors that cause owners to overprice their properties:

- Emotional attachment – For most, a home is more than just an asset. Years of memories make it hard to be objective.

- Numb to flaws – Owners become blind to their property’s faults. Buyers will notice shortcomings like dated kitchens.

- Focus on improvements – Owners may overspend on renovations and wrongly assume the home’s value has increased proportionately.

- Judge by investment – The purchase price and money spent over the years bears little relevance to current market demand.

The Risks of Inaccurate Property Valuations

Believing your home is worth significantly more than its true market value can cause major problems:

- No sale – An overpriced property may get no buyers interested, costing time and money.

- Financial strain – Overpaying for a new home places mortgage stress on the buyer.

- Inheritance issues – Inflated valuations complicate dividing assets among heirs.

- Divorce disputes – Couples may argue over the true value of a home in separation proceedings.

Getting an Accurate and Objective Property Appraisal

To get a true gauge of their home’s current value, owners should:

- Hire an independent certified valuer – They will impartially assess your property’s market price.

- Get multiple valuations – Comparing appraisals from different experts provides a balanced perspective.

- Research recent comparable sales – Seeing what similar nearby homes have sold for gives a real-world value indication.

What is Mass Appraisal and How Does it Work in Australia?

Mass appraisal is the process of valuing multiple properties at once using automated valuation models (AVMs). This allows assessors to efficiently value large numbers of properties for property taxation purposes.

How Mass Appraisal Works

Mass appraisal relies on statistical modelling using recent sales data for comparable properties. The valuations are generated by computer algorithms rather than individual physical property inspections.

Key features of mass appraisal in Australia include:

Automated Valuation Models

AVMs analyse various property features like size, location, number of bedrooms, bathrooms etc. and compare them to sold properties with similar attributes. Mathematical modelling is used to calculate property values.

Property Sales Database

Authorised property sales data is fed into the AVM providing vital comparable sales information. This includes land values, sale prices, property features, and date of sale.

Geographic Information Systems

GIS provides spatial data like zone maps, allowing the AVM to understand geographic influences on property values. Location within a zone significantly impacts values.

Statistical Analysis

Powerful analytics examine sales trends and property influencing factors. This enables accurate modelling of value changes over time.

Regular Updates

As new sales occur, the data is added to the valuation models keeping them up to date and valuations accurate. This allows flexibility in a changing market.

Oversight

Although automated, qualified valuers oversee the process including verifying results and making adjustments to model weaknesses.